Daily Insights Hub

Your go-to source for the latest news and information.

Insurance Savings Unleashed

Unlock hidden insurance savings and discover tips to slash your premiums today! Don't miss out on huge savings!

Top 5 Hidden Ways to Cut Your Insurance Costs

When it comes to managing your finances, one of the most significant expenses can be insurance premiums. However, there are hidden ways to cut your insurance costs that many people overlook. Start by reviewing your current policies and identifying any overlaps. For example, bundling home and auto insurance often leads to substantial discounts. Additionally, consider increasing your deductibles; this can drastically lower your premium rates. It's essential to evaluate these options carefully to ensure you're not compromising your coverage.

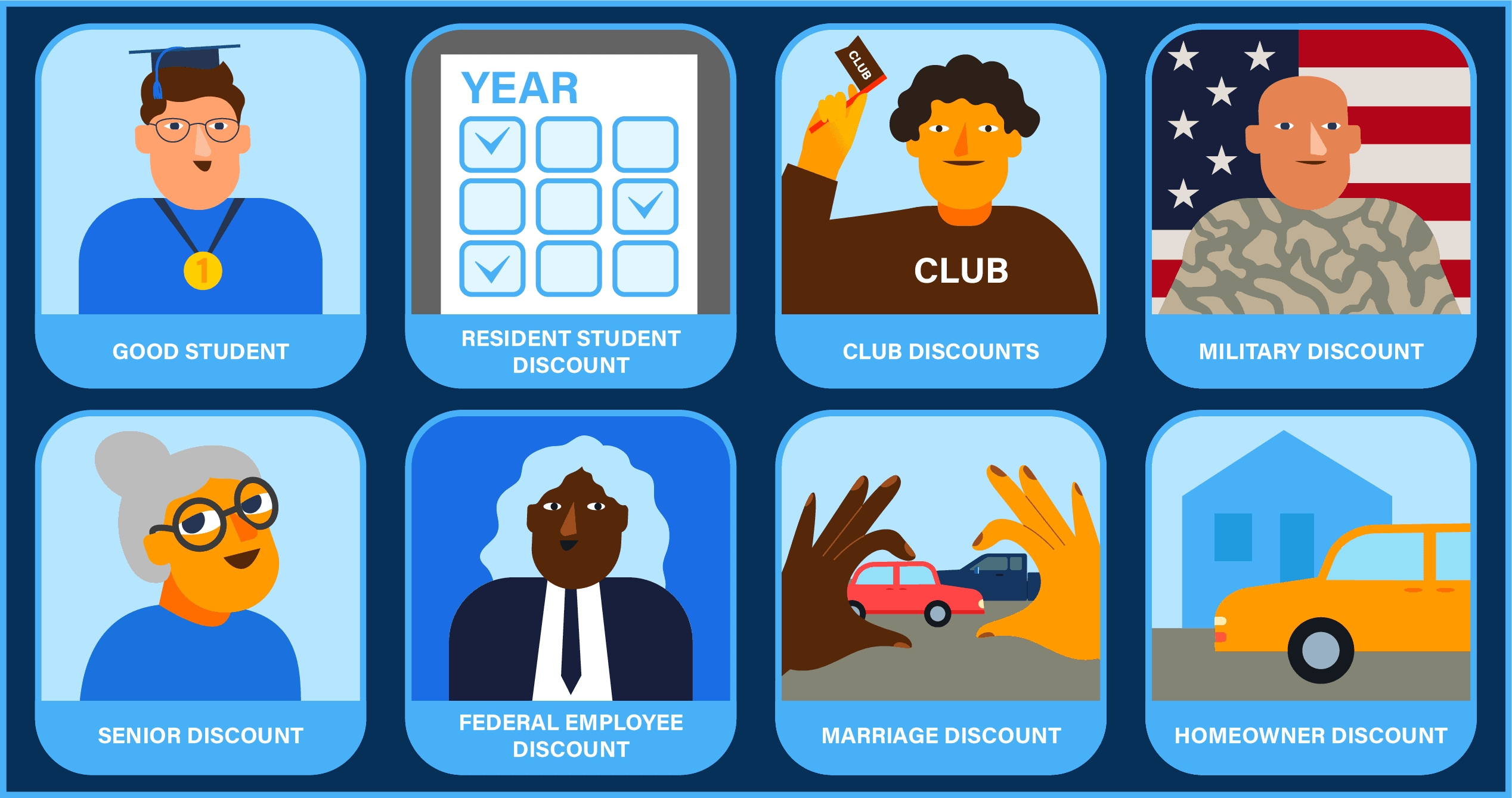

Another effective strategy involves taking advantage of available discounts. Insurance providers frequently offer discounts for safe driving, good grades for students, or even for participating in defensive driving courses. Don’t hesitate to ask your insurer about any potential discounts you might qualify for. Additionally, maintaining a good credit score can positively impact your rates, as many insurers consider credit history when calculating premiums. By employing these hidden methods to reduce your insurance costs, you can save money without sacrificing coverage.

Understanding Discounts: Are You Getting the Best Deals on Your Insurance?

Understanding discounts on your insurance is crucial for maximizing savings and ensuring you are not overpaying. Many insurance providers offer a variety of discounts, which can significantly reduce your premiums. Common types of discounts include multi-policy discounts, which reward customers for bundling multiple insurance policies such as home and auto, and safe driver discounts that benefit those with a clean driving record. To fully leverage these savings, it's important to regularly review your policy and inquire about any available discounts that may apply to your situation.

Additionally, consider the following strategies to secure the best deals on your insurance:

- Shop around: Comparing quotes from different insurers can reveal better rates and discounts.

- Ask about loyalty discounts: Some companies offer rewards for long-standing customers.

- Maintain a good credit score: Insurance companies may offer lower rates to customers with good credit.

By understanding how these discounts work, you can ensure that you're making the most informed decisions regarding your insurance policies and potentially save a significant amount of money over time.

Is It Time to Revise Your Insurance Policies for Maximum Savings?

As we navigate through changing financial landscapes, revising your insurance policies becomes an essential task for maximizing savings. Regularly evaluating your coverage ensures that you are not overpaying for services you may not need or missing out on discounts that could significantly reduce your premiums. It is a good practice to review your policies at least once a year or after major life events such as marriage, home purchases, or adding a new family member. This proactive approach not only helps you save money but also keeps your insurance aligned with your current needs and circumstances.

When considering whether it is time to revise your insurance policies, look for signs like changes in your lifestyle, shifts in the economy, or updates in insurance company offerings. Additionally, don’t hesitate to ask your insurance provider about possible discounts or bundling options that might be available. Remember, maximizing savings doesn’t always mean lowering coverage; it can often involve optimizing it. Taking the time to assess your policies can lead to substantial savings, ensuring that you are protected without stretching your budget.