Daily Insights Hub

Your go-to source for the latest news and information.

The Secret Life of Renters Insurance: What You Didn't Know

Unlock the hidden benefits of renters insurance—discover what you never knew could protect your home and savings!

Top 5 Myths About Renters Insurance Debunked

When it comes to renters insurance, there are plenty of misconceptions that can lead to confusion among tenants. One common myth is that renters insurance is unnecessary if you live in a safe neighborhood. However, it's crucial to understand that theft, fire, and natural disasters can happen anywhere, regardless of safety levels. Having renters insurance provides peace of mind knowing that your personal belongings are protected against unforeseen circumstances, so it's better to have coverage than to risk losing everything.

Another prevalent myth is that renters insurance only covers personal belongings. While this is partially true, many policies also offer liability coverage, which protects you if someone is injured in your unit. Additionally, some policies provide additional living expenses if your residence becomes temporarily uninhabitable due to a covered event. It's essential to thoroughly review your policy to understand the full range of protections and ensure you have adequate coverage for your needs.

What Does Renters Insurance Actually Cover? A Deep Dive

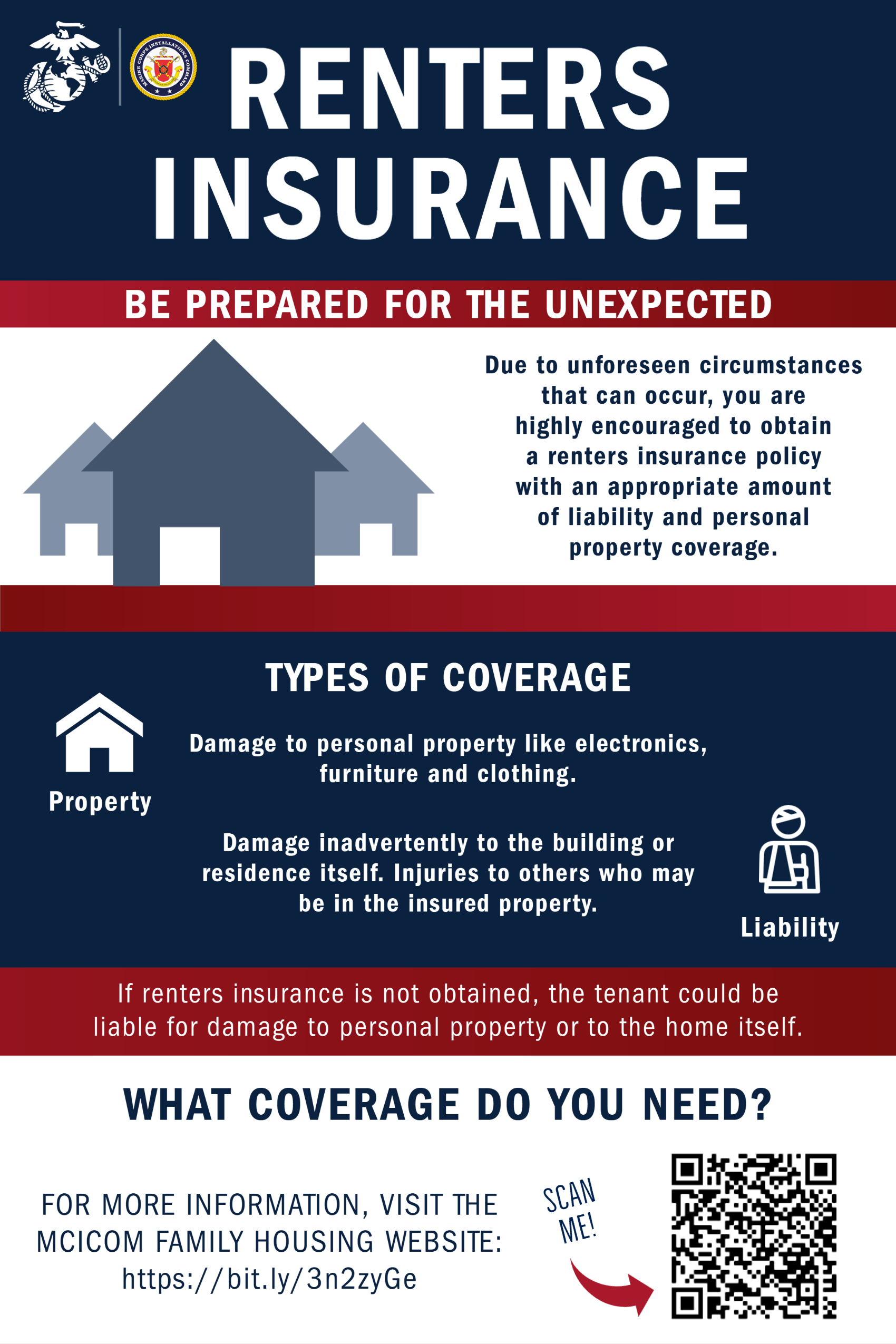

Renters insurance is designed to protect tenants from unforeseen events that can disrupt their lives. The coverage typically includes personal property, which protects your belongings against risks such as theft, fire, or vandalism. For instance, if a fire were to damage your personal items, your renters insurance could reimburse you for their loss, ensuring that you can replace essential items like electronics, furniture, and clothing. Additionally, policies often cover liability protection, safeguarding you against legal claims if someone is injured in your rented space, which can cover legal fees and medical expenses.

Beyond personal property and liability protection, renters insurance also often includes additional living expenses (ALE) coverage. This aspect of the policy assists in covering the costs of temporary housing and living expenses if your rental becomes uninhabitable due to a covered peril, such as severe water damage. It's crucial to carefully read your policy to understand the specifics of your coverage. By knowing what your renters insurance includes, you can ensure your belongings and finances remain protected against unexpected events.

Is Renters Insurance Worth It? Here's What You Need to Know

When considering if renters insurance is worth it, it's essential to understand its purpose and benefits. Renters insurance provides financial protection for your personal belongings in the event of theft, fire, or other disasters. Without it, you would be responsible for replacing your items out of pocket, which could result in significant financial strain. In fact, reports indicate that the average renter has around $20,000 worth of personal property, making it prudent to consider this coverage.

Moreover, renters insurance often includes liability protection, which safeguards you against potential claims if someone is injured in your rental property. This feature can prevent costly legal fees and settlements. Additionally, most policies are quite affordable—typically ranging from $15 to $30 per month—making it a small price to pay for peace of mind. Ultimately, investing in renters insurance is a wise decision to protect your belongings and financial wellbeing.