Daily Insights Hub

Your go-to source for the latest news and information.

Why Renters Insurance Is Like an Umbrella in a Hurricane

Discover why renters insurance is your essential safety net in life's storms—protect your belongings and peace of mind today!

How Renters Insurance Provides Protection in Times of Crisis

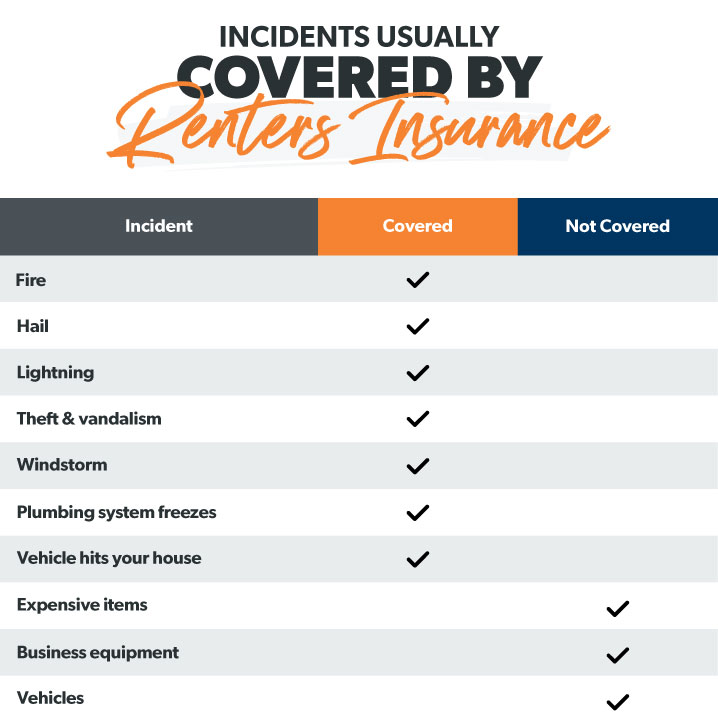

Renters insurance serves as a crucial safety net for individuals facing unexpected crises such as natural disasters, theft, or accidents within their rental properties. In times of turmoil, having this type of insurance can alleviate the financial burden associated with lost or damaged personal belongings. For instance, if a severe storm damages your apartment or a fire destroys your belongings, renters insurance can help cover the costs of replacing items like electronics, furniture, and clothing. Without this protection, renters may find themselves bearing the full financial brunt of their losses, which can be overwhelming and lead to long-term financial strain.

Moreover, renters insurance goes beyond just protecting personal property; it can also provide liability coverage in the event of accidents that occur within your rented space. This means that if someone is injured while visiting your home, renters insurance can help cover legal expenses or medical costs, which can be particularly significant during a crisis. By investing in renters insurance, tenants not only safeguard their possessions but also ensure peace of mind knowing that they have a safety net in place. In a world where uncertainties abound, having this protection is not just wise; it is essential.

The Importance of Renters Insurance: Shielding Your Belongings from Unexpected Storms

In today's unpredictable world, having renters insurance can be a lifeline for tenants facing unexpected challenges, especially when severe weather strikes. Storms can cause extensive damage to personal property, leaving renters vulnerable to loss or destruction. By investing in renters insurance, individuals can safeguard their belongings against unforeseen events such as floods, tornadoes, or hurricanes. With the right coverage, renters can quickly recover from potential financial setbacks and protect their investments, ensuring peace of mind when the skies turn dark.

Furthermore, renters insurance often includes personal liability protection, which can offer additional security during storm-related accidents or damages. For instance, if a fallen tree causes injury to a neighbor or damages their property, having renters insurance would help cover legal expenses and damages. This coverage is crucial because it reassures tenants that they are equipped to handle the consequences of unexpected storms and accidents. In summary, obtaining renters insurance is not just a smart financial decision, but an essential step in shielding your valuables and ensuring you are prepared for any storm life may throw your way.

Is Your Peace of Mind Worth It? The Essential Role of Renters Insurance During Severe Weather

When severe weather strikes, the peace of mind that comes from having renters insurance can be invaluable. Many people underestimate the importance of protecting their belongings, especially when renting their homes. However, natural disasters like hurricanes, floods, and tornadoes can wreak havoc, leaving renters vulnerable to significant financial loss. With renters insurance, you not only safeguard your personal possessions—such as electronics, furniture, and clothing—but also secure additional living expenses in case you're displaced. This essential coverage ensures that you're not left to bear the entire brunt of unexpected costs and damages.

Moreover, renters insurance can play a critical role in helping you recover from the aftermath of severe weather. This type of policy often covers liability protection, which means that if someone is injured on your property due to weather-related incidents, you won't suffer the financial consequences alone. In a time of crisis, the last thing you need is to deal with added stress. Investing in renters insurance not only helps protect your belongings and ensure your safety but also allows you to focus on what truly matters—your recovery and rebuilding your life after the storm.