Daily Insights Hub

Your go-to source for the latest news and information.

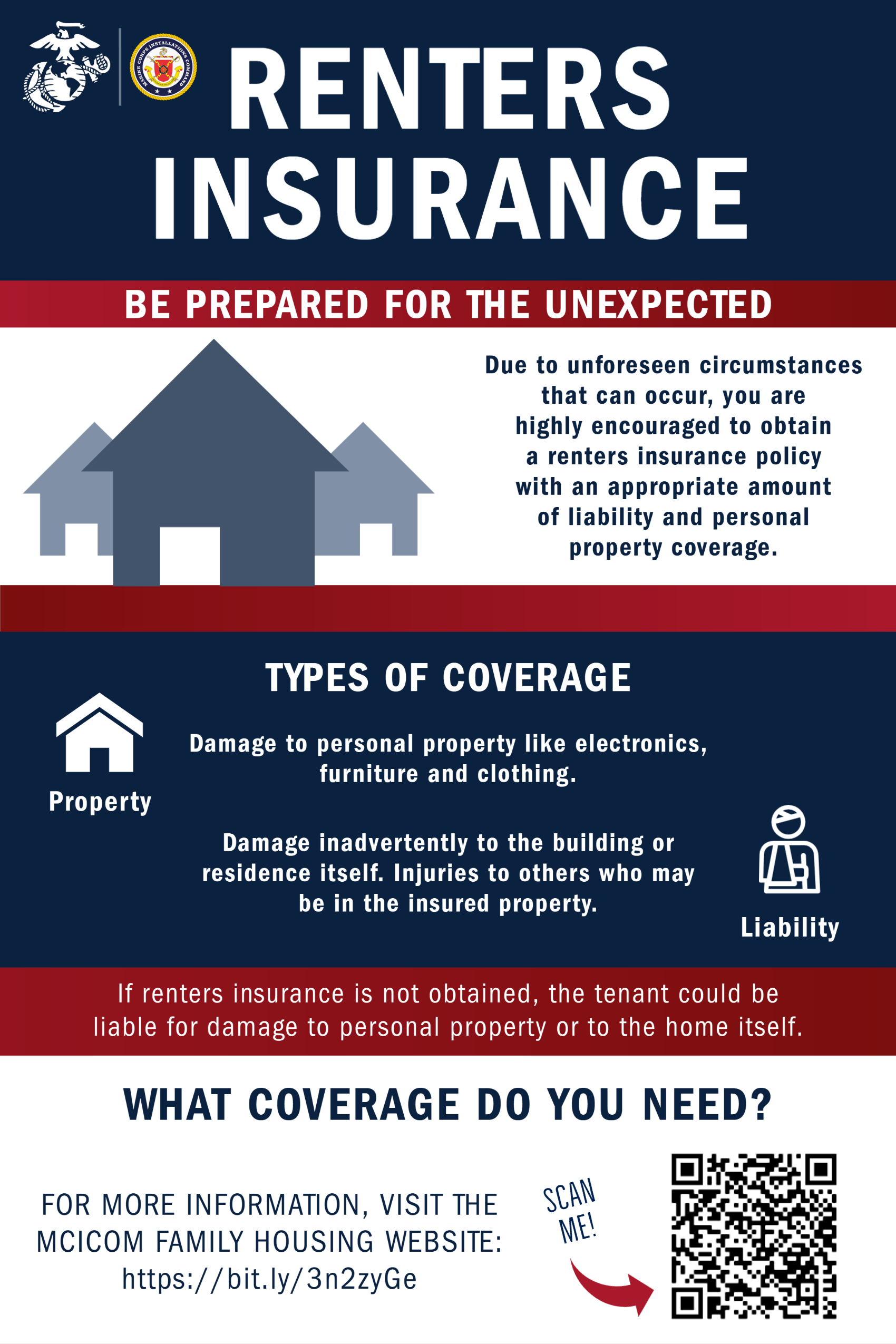

Insurance for Renters: Because Life Happens When You're Renting

Protect your belongings and peace of mind! Discover why renters insurance is a must-have when life throws you a curveball.

Understanding Renters Insurance: What Does It Cover?

Renters insurance is a vital form of coverage for individuals who rent their homes. It primarily protects your personal belongings within the rented space, such as furniture, electronics, and clothing, from a variety of risks including theft, fire, and certain natural disasters. Most policies also offer liability coverage, which can safeguard you in case someone is injured while in your rental property. Understanding what renters insurance covers is essential for making informed decisions about your policy and ensuring you’re adequately protected.

In general, renters insurance covers the following key categories:

- Personal Property: This includes your belongings, and most policies cover theft and damage from events like fire and vandalism.

- Liability Protection: This aspect helps cover legal costs if someone sues you for injuries that occur in your rented space.

- Additional Living Expenses: If your rental becomes uninhabitable due to a covered peril, this can help pay for temporary housing and related costs.

Common Myths About Renters Insurance Debunked

Myth 1: Renters insurance is too expensive. Many people believe that the cost of renters insurance is prohibitively high, but the reality is that it often costs less than a cup of coffee a day. In fact, according to industry averages, renters insurance typically ranges from $15 to $30 per month, depending on the coverage and location. This small investment offers significant peace of mind, protecting personal belongings from theft, fire, and other unforeseen events.

Myth 2: Renters insurance is unnecessary if you don’t own valuable items. This common misconception leads many renters to forgo insurance, thinking they aren't at risk because they don't possess expensive possessions. However, even everyday items like electronics, clothing, and furniture can add up to a substantial amount. Without renters insurance, a single event such as a burst pipe or fire could result in significant financial loss. Therefore, having renters insurance is crucial for safeguarding your belongings, regardless of their perceived value.

Why Renters Insurance is Essential: Real-Life Scenarios

Many renters underestimate the importance of renters insurance, thinking that their belongings are safe or that their landlord's insurance will cover any potential damages. Consider a scenario where a tenant, Sarah, comes home to find her apartment flooded due to a burst pipe. The damage to her electronics, furniture, and clothing totals thousands of dollars. Without renters insurance, Sarah is left to cover these costs out of pocket, which could significantly impact her financial stability.

Another real-life example involves theft. Imagine John, who lives in a bustling city, returning from vacation only to discover that his apartment has been broken into. His laptop, television, and several valuable items have been stolen. Thankfully, John had renters insurance, which not only compensates him for his losses but also helps cover unexpected expenses related to the theft, such as temporary housing or repairs. This shows that renters insurance is not just a safety net; it is essential for protecting personal property and ensuring peace of mind in unpredictable circumstances.